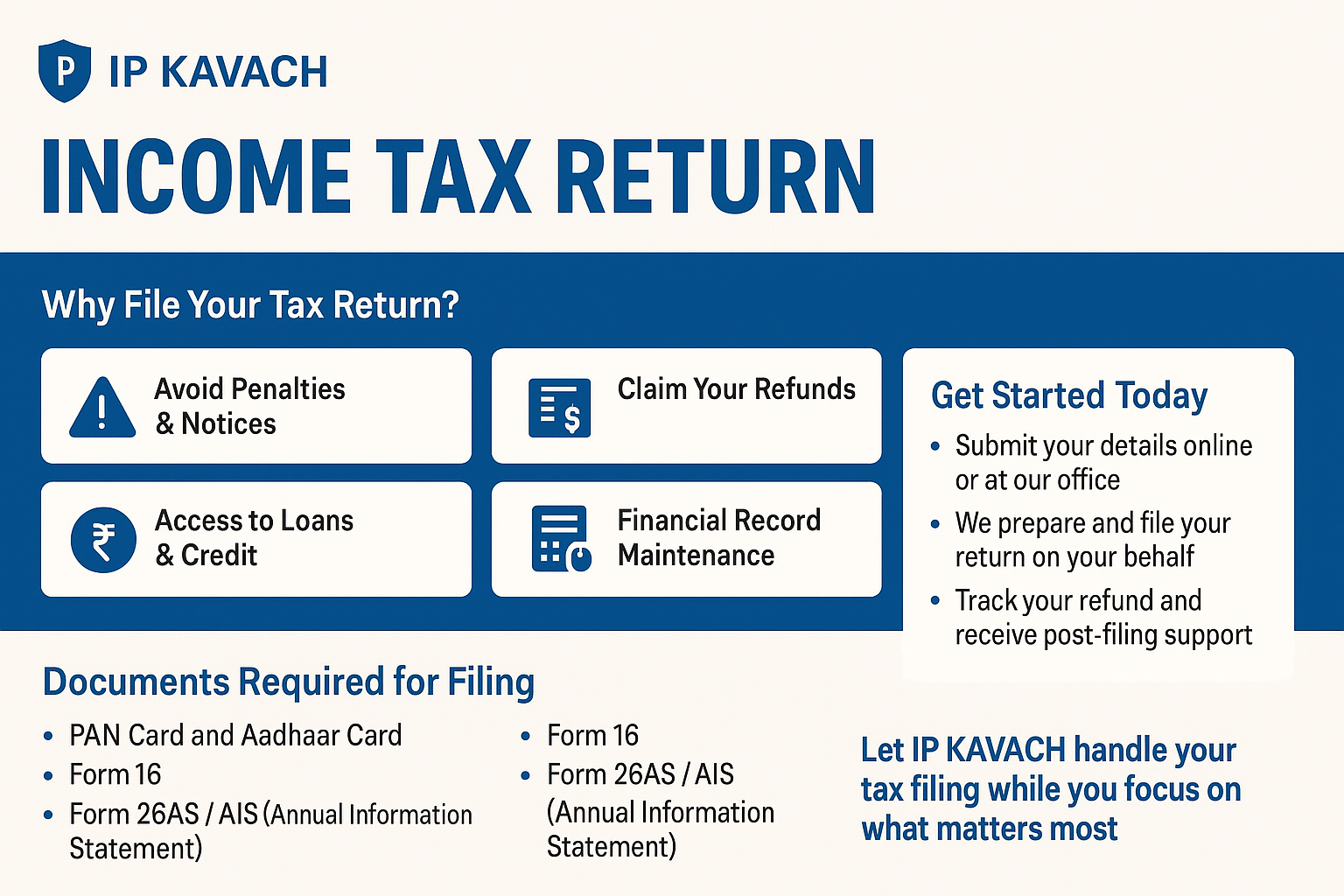

Filing your Income Tax Return (ITR) is not just a legal obligation—it is an essential step in maintaining a strong financial record, avoiding penalties, and claiming your rightful refunds. At IP KAVACH, we simplify the entire process with our professional tax experts, ensuring your return is filed accurately, securely, and on time.

Avoid Penalties & Notices

Filing late or not filing at all can lead to heavy penalties and notices from the Income Tax Department.

Claim Your Refunds

If you’ve paid excess tax through TDS or advance tax, you can only claim a refund by filing your return.

Access to Loans & Credit

ITRs serve as a financial proof when you apply for personal, vehicle, or home loans.

Financial Record Maintenance

Regular filing creates a verified income history that benefits you in the long run.

Compliance for Businesses & NRIs

Whether you’re a business owner, freelancer, or NRI, timely filing ensures full compliance and peace of mind.

At IP KAVACH, we follow a step-by-step process to make your tax filing seamless:

Document Collection & Review

We guide you on the required documents (Form 16, PAN, Aadhaar, 26AS, investments, capital gains details, etc.).

Your data is reviewed to identify deductions and potential refunds.

Accurate Return Preparation

Our experts prepare your return using the correct ITR form as per your income sources.

All deductions, exemptions, and set‑offs are carefully applied.

Client Verification

A draft return is shared with you for review before submission.

Any questions are addressed before proceeding.

E‑Filing & E‑Verification

We file your return electronically and assist you with e‑verification through Aadhaar OTP, Net Banking, or DSC.

Post‑Filing Support

We track your refund status and assist with any queries or notices from the Income Tax Department.

We offer specialized tax return filing services for all categories of taxpayers:

Salaried Employees & Pensioners – Filing ITR‑1 or ITR‑2 with Form 16, HRA, investments, etc.

Business Owners, Firms & LLPs – Income computation, depreciation, audits, and statutory compliance.

Freelancers & Consultants – Filing under presumptive taxation or regular books of accounts.

Non‑Resident Indians (NRIs) – Handling foreign income, DTAA benefits, and disclosure of foreign assets.

Investors with Capital Gains – Property sales, stocks, mutual funds, or cryptocurrency transactions.

HUFs & Trusts – Filing ITR‑5 and ITR‑7 with complete compliance.

PAN Card and Aadhaar Card

Form 16 (for salaried individuals)

Form 26AS / AIS (Annual Information Statement)

Bank statements and interest certificates

Details of investments, insurance, and tax‑saving proofs

Capital gains statements (shares, property, crypto, etc.)

Rental income or property documents (if applicable)

Previous year’s ITR (if any)

We don’t just file your return—we optimize it for maximum benefits. Our team checks for:

Missed deductions under Section 80C, 80D, etc.

Correct computation of capital gains

Adjustments of advance tax and TDS credits

Proper reporting of multiple income sources

Avoiding triggers that can lead to scrutiny

Our personalized approach ensures you stay fully compliant while minimizing your tax liability.

Expertise You Can Trust – Experienced tax professionals with deep knowledge of Indian tax laws.

End‑to‑End Support – From document collection to refund tracking, we manage it all.

Accurate & Error‑Free Filing – Each return is reviewed multiple times before submission.

Timely Filing Guarantee – We ensure you meet all statutory deadlines, avoiding last‑minute rush and penalties.

Secure Data Handling – Your sensitive financial information is protected with the highest levels of security.

Filing your tax return with IP KAVACH is quick and easy:

Submit your details online or at our office

Receive a list of required documents

We prepare and file your return on your behalf

Track your refund and receive post‑filing support

👉 Let IP KAVACH handle your tax filing while you focus on what matters most.

We promise accuracy, security, and timely filing—every time.