At IP KAVACH, we provide a complete GST registration solution that’s fast, transparent, and legally accurate.

✅ Here’s What We Do for You:

1. Eligibility Assessment & Business Analysis

We begin with a consultation to:

Understand your business model

Determine if GST registration is mandatory or voluntary

Identify the correct GST category (Regular, Composition, Casual, etc.)

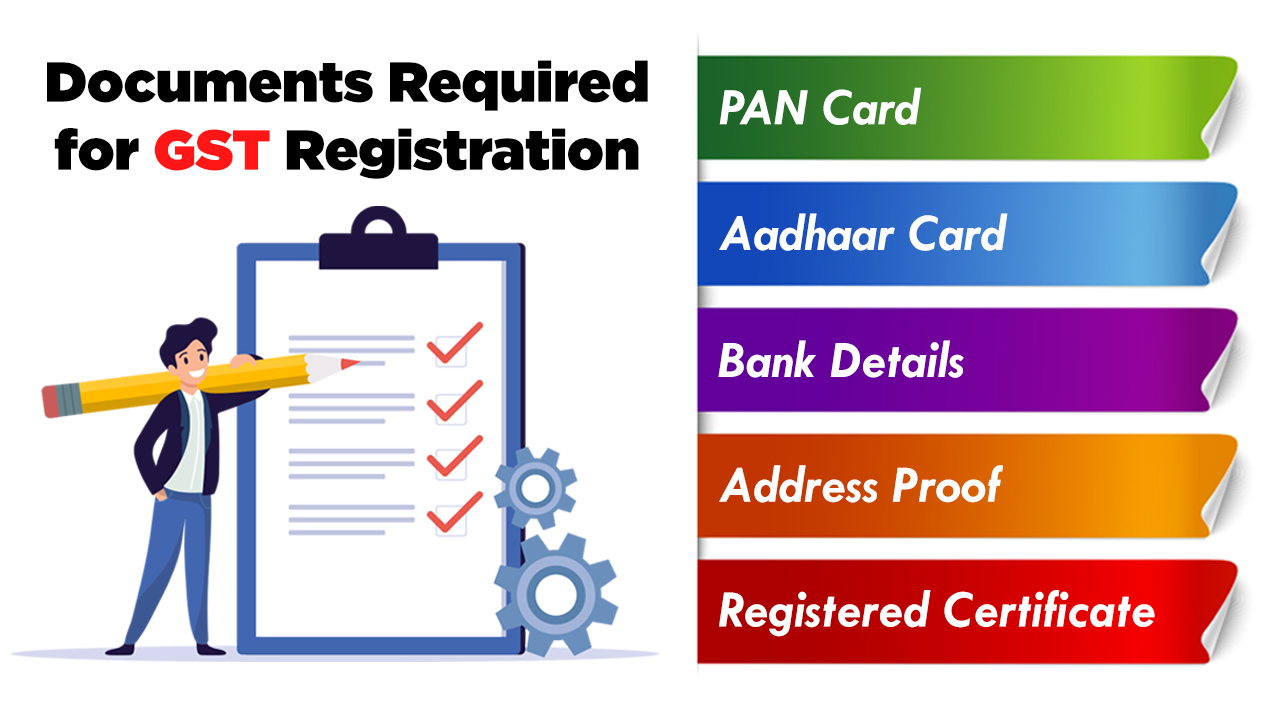

2. Document Collection & Verification

We assist you in gathering all necessary documents:

PAN Card

Aadhaar Card

Proof of business address

Bank details (statement/canceled cheque)

Passport-size photo (for proprietors)

Business constitution certificate (for companies/LLPs)

Our team carefully checks each document to avoid any rejections.

3. Filing of GST Application

Once documentation is complete:

We file your GST REG-01 application online

Attach the supporting documents in prescribed format

Coordinate for OTP/verification steps

For companies or LLPs, we help generate a Digital Signature Certificate (DSC) if required.

4. Government Follow-ups

We proactively track your application status, address department queries, and ensure all steps are followed to secure timely approval.

5. GSTIN Issuance

Upon approval, we deliver:

Your GSTIN (Goods & Services Tax Identification Number)

GST Certificate

Login credentials to the GST portal